Analysis of China's valve industry investment prospects from 2020 to 2024

- Share

- Issue Time

- Jul 27,2020

Summary

Analysis of China's valve industry investment prospects from 2020 to 2024

1. The influence of upstream and downstream on the valve industry

1. The impact of upstream industries on the valve industryThe upstream of the valve industry is mainly the production of industrial raw materials such as castings, forgings, and seals. In general, the entry threshold of the upstream valve industry is not high, and it is in a state of full competition, with sufficient product supply, which does not restrict the normal production of valve companies.

2. The influence of downstream industries on the valve industryThe downstream industries of the valve industry mainly include oil and gas, electric power, chemicals, tap water and sewage treatment, papermaking, metallurgy, pharmaceuticals, food, mining, non-ferrous metals, electronics and other industries. Valves are mainly used in the field of fluid control in industrial processes in these industries. Therefore, valve demand is closely related to fixed asset investment in downstream industries. The improvement of the downstream industry's prosperity will drive the increase of related fixed asset investment, which in turn will drive the growth of valve demand.

2. The global market size and structure of the valve industry in 2019

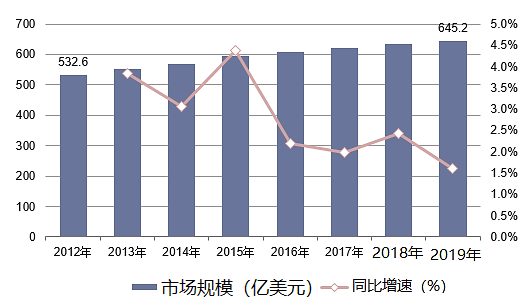

From the perspective of the scale of the global industrial valve market, the global industrial valve market demand in 2019 was about 64.52 billion U.S. dollars, an increase of 11.26 billion U.S. dollars from 2012. The compound growth rate from 2012 to 2018 was about 3%. Among them, the global industrial valve industry exceeded 50 billion U.S. dollars in 2019. The valve will be used for renovation, accounting for about 80%.

Chart 2 2012-2019 global industrial valve market scale and growth

Data source: China Investment Industry Research Institute

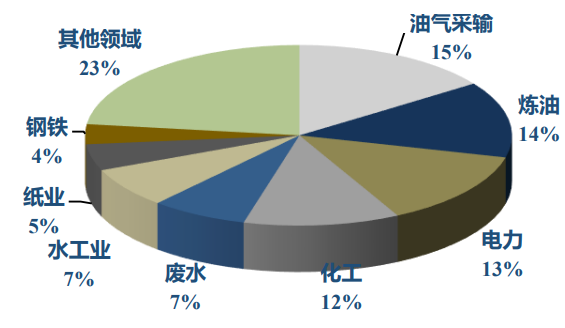

Oil and gas refining, energy and chemical industries are the most important downstream applications of valves. Valve products are widely used in oil and gas, energy, chemical industry, environmental protection, steel, food, medicine and other fields. The "Investment Analysis and Prospect Forecast Report of China's Valve Industry for 2020-2024" issued by the China Investment Industry Research Institute shows: Global Oil and Gas in 2019 , Oil refining, power and chemical industries have the largest demand for industrial valves, accounting for 15.3%, 13.6%, 13.5% and 11.8% in order. The above-mentioned four fields account for about 54.2%.

Chart 3 the proportion of global valve downstream applications in 2019

Data source: China Investment Industry Research Institute

3. Market scale of China's valve industry in 2019

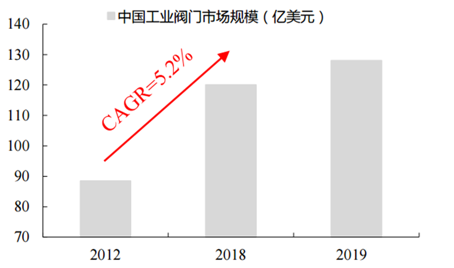

China's industrial valve market is growing faster than the world, and its consumption scale accounts for more than 20% of the global market, becoming the largest consumer country. According to the "Report on China's Valve Industry Investment Analysis and Prospects for 2020-2024" issued by the China Investment Industry Research Institute, the domestic industrial valve market scale was 8.8 billion yuan in 2012, and the domestic industrial valve market scale reached 12 billion US dollars in 2018. The CAGR is 5.2%, faster than the global growth rate, and the global market share has reached 19.5%. It has become the world's largest consumer of industrial valves. In 2019, the domestic industrial valve market is about 13 billion U.S. dollars. Different from the valve demand in developed countries, which is mainly updated and maintained, about 90% of my country's valve demand is still composed of new demand, and the development horsepower is still strong. It is estimated that in the next three years, my country's industrial valve industry can still maintain a growth rate of about 5-7%, and the domestic market will reach 15.5-17.7 billion yuan by 2023.

Chart 10 2012-2019 China's industrial valve market market size

Data source: China Investment Industry Research Institute

The specialized production of single-sign valves is still at a low-level stage in China. Compared with foreign companies in the same industry, Chinese local companies started technically later, but domestic manufacturers in a leading position in the industry have formed a certain brand effect and are looking for Differentiated positioning, further advance to the high-end market, and seize market share of foreign companies.

China's fast-growing valve market and related industrial policies provide support. It provides great development space for outstanding domestic companies. Local outstanding companies that have grown up in full competition with foreign brands are expected to grow and expand as the market develops and play an increasingly important role in the entire industry.

With technological innovation and industrial progress and development, the development speed of oil and gas continues to increase, and the related supporting competition in various industries is becoming increasingly fierce. After decades of development in the energy sector in China, the development, performance, quality, and reliability of products Great progress has been made in terms of sex and service. The valve industry is also developing in the direction of high automation, intelligence, multi-function, high efficiency, and low consumption. Valves are necessary for sewage treatment, papermaking, metallurgy, oil and gas, and production processes. In the next 10 years, new valve products for nuclear power, hydropower, large-scale petrochemical, oil and gas gathering pipelines, coal liquefaction and metallurgy and other major projects will become the focus of development and are expected to lead the rapid growth of the entire industrial valve market.

4. Number of companies in China's valve industry in 2019

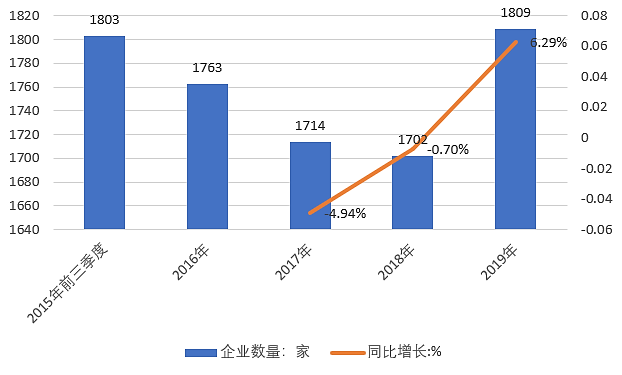

According to data from China General Machinery Association, from 2016 to 2019, the number of enterprises above designated size in the valve industry in my country fluctuated. From 2016 to 2018, the number of industry companies showed a downward trend. In 2018, it was 1,702, a decrease of 0.7% year-on-year, which was the lowest in history; in 2019, the number of industry companies rebounded to 1,809, an increase of 6.29% year-on-year.

Chart 12: 2015-2019 the number and growth of Chinese valve enterprises above designated size.

Unit: Home,%

Data source: China General Machinery Association